You have a great idea, a viable product or service, and a passion for what you want to achieve. Excellent! But before you dive headfirst into your new venture, there are several things to consider when starting a new business.

For example, it’s important to put together a solid business plan, determine your business structure, think about how you’ll fund your business, and many other factors. It’s also important to consider the right insurance coverage for your new business venture.

In this post, we’ll review some of the things you should think about when starting a new business, including insurance.

Planning

One of the first things to consider when starting a new business is how viable your product or service may actually be. This is where proper planning comes into play.

The planning process should include researching your market and competitors, identifying your unique selling proposition (USP), setting achievable goals, and developing a comprehensive business plan.

Planning allows you to understand and analyze your business idea from all angles and sets the foundation for a strong start. It also helps you develop a strong business plan that outlines your objectives, strategies, and projected financials.

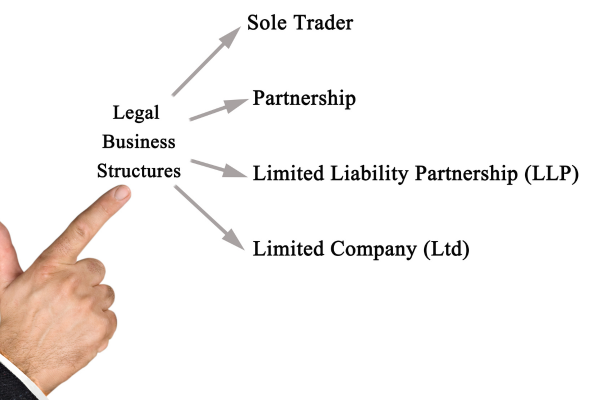

Business Structure

Starting a new business may also require you to jump through a plethora of legal hoops.

Be sure to research the legal framework and requirements applicable to your product or service. You’ll also need to obtain any necessary permits and licenses for your business.

Choosing a legal structure for your business is also a critical decision. It determines how your business will be taxed and how you will be liable for debts and legal issues.

The most common structures include a sole proprietorship, partnership, corporation, and limited liability company (LLC).

Funding

Once you’ve done your market research, created your business plan, and considered your business structure, it’s time think about funding.

This can potentially be the most challenging part of starting your new business. However, there are many viable funding options.

For example, you can start with your personal savings or loans from family and friends. Small business loans or crowdfunding are also potential funding sources for your new business.

Whatever funding route you take, do your due diligence, and choose one that’s right for your business.

Marketing

When developing your marketing plan, identify your target audience and determine how best to establish your brand identity.

Be sure to tailor your marketing messages to your target audience through a multi-channel marketing strategy.

This can include social media, email marketing, search engine optimization (SEO), content marketing, and paid advertising campaigns.

Your marketing plan should also include a realistic marketing budget to help you meet your growth objectives.

Business Insurance

While insurance may not be the most glamorous aspect of starting a new business, it is one of the most important. Without it, you could put your company and yourself at risk.

There are several types of insurance policies available for businesses. These include general liability insurance, professional liability insurance, workers’ compensation, property insurance, cyber liability insurance, and others.

Be sure to work closely with an insurance agent, like BR Risk Group™ Specialty Insurance, who will take the time to understand your business. By working with an experienced insurance agent, you can ensure your business gets the right insurance coverage.

Conclusion

Starting a new business can be a daunting task. From the business structure to funding, there are a lot of things to consider when starting a new business.

However, with the proper planning, funding, legal considerations, marketing, and unwavering focus on your customers, your business could be the next big success story!

And while business insurance may seem like an additional expense, the cost of not having it could be much higher in the long run. It’s essential to assess your risks and work closely with an experienced insurance agent to identify the coverage you need for your specific industry and business structure.